The $35.4 Trillion Problem

US Government debt stands at $35.4 trillion and growing as the US government has a spending deficit close to 4% of GDP. This has worried many investors, but, should they really worry? Is fixed income uninvestable? In this article, we will analyse whether bonds are attractive or not.

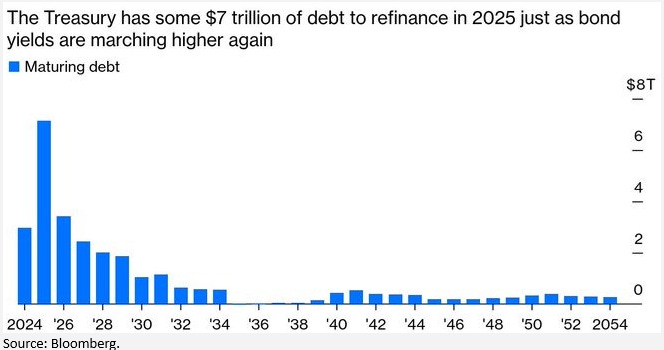

The +$7 Trillion Refinance:

As we approach 2025, the U.S. government faces the task of refinancing and issuing over $7 trillion in debt. While the theoretical increase in supply could exert upward pressure on yields, we anticipate the refinancing process will proceed smoothly, supported by the current composition of U.S. debt holders.

Foreign ownership accounts for just 25% of total U.S. debt, with China holding a modest 2%. Geopolitical tensions may lead to reduced Chinese participation, but this is unlikely to disrupt the broader refinancing effort. Other major foreign holders, constrained by lower-yielding alternatives and weaker currencies, find U.S. Treasuries highly attractive at current yields, ensuring sustained demand.

In addition, domestic demand also remains robust, driven by institutional investors (Pension funds, mutual funds, Federal Reserve, etc) being forced to buy due to their investment mandate and base currency.

Inflation:

Inflation remains the key risk factor dominating the economic outlook. In the short term, several upside risks could keep headline inflation elevated. These include tariffs and geopolitical tensions that disrupt supply chains, reducing the supply of critical commodities such as oil and fertilizers. At the same time, goods and services inflation may accelerate as economic optimism continues to build.

Core inflation, however, is already showing signs of slowing, albeit at a diminishing pace each month. If core inflation stabilizes around 3.5–4%, it could prompt 1 or no rate cuts next year. Conversely, if core inflation reaccelerates, further rate hikes remain a possibility. Such a scenario would likely have a bearish impact on both bonds and equities, particularly given the S&P 500’s current tech-heavy composition, which is more sensitive to higher interest rates.

Yield to Duration Ratio:

As interest rates rise, a bond’s value decreases due to its sensitivity (duration), but the coupon payments help offset these losses.

The chart above illustrates the current yield-to-duration ratios for U.S. Treasuries across different maturities. This ratio indicates the percentage increase in yields required for a bondholder to break even, where the loss in bond price due to rising rates is fully offset by the coupon yield received. Notably, longer dated bonds, have a lower ratio, hence a higher risk. a 0.39% increase in 20Y bonds yield, would wipe out all the gains from that year's coupon.

Conclusion:

We believe core inflation will remain sticky around 3–4%, keeping interest rates higher for longer under current economic conditions. In this environment, we favor 5-year bonds yielding 5% over 2-year bonds. This preference stems from the opportunity to lock in nearly the same yield for a longer duration, coupled with a yield-to-duration ratio close to 1. This implies that yields would need to rise to 6% for the price decline to offset the carry gains—a scenario we view as highly unlikely, making 5-year bonds more attractive on a risk-adjusted basis.